Originally published on World Economic Forum on 19th January 2021 as part of the Davos Agenda

- In the wake of the COVID-19 pandemic, small businesses in least developed countries (LDCs) are seeing revenues plummet and are struggling to access financing.

- Many LDCs depend on foreign aid, and are fearful that cuts to aid budgets will further set back their economic development.

- It’s crucial that aid funding is spent as effectively as possible to attract more private investment to LDC small businesses.

- The private sector is ready. Funds such as the SDG500 are already supporting small businesses in LDCs to remain afloat.

Small businesses in the world’s least developed countries (LDCs) are facing enormous challenges. Many have been left cash-strapped due to plummeting revenues during national and global COVID-19 lockdowns. Banks and other financiers have slashed lending at a time when small businesses need it most. And other forms of finance and credit are thin on the ground, making it nearly impossible for them to grow and build financial resilience.

For decades, many small businesses in LDCs have depended heavily on official development assistance, or aid. Aid has enabled entrepreneurs to take their businesses online, access new markets, meet export standards, and much more. The growth of small businesses in LDCs, and the level of employment that has created for women and youth in particular, has been a crucial part of sustainable development.

However, COVID-19 is already impacting how and where aid is spent. Several government donors have reprogrammed their aid budgets to fund immediate and urgent health priorities and humanitarian assistance in 2020. And this doesn’t look like it will change in the short term. Despite international organizations calling on governments to maintain aid budgets in 2021, fears are spreading that governments are planning to slash billions from their aid budgets.

Amid this uncertain and concerning economic climate, it’s crucial to ensure that aid is spent in a way that attracts private sector investment and ultimately makes funds go further.

Blended finance offers hope for small businesses

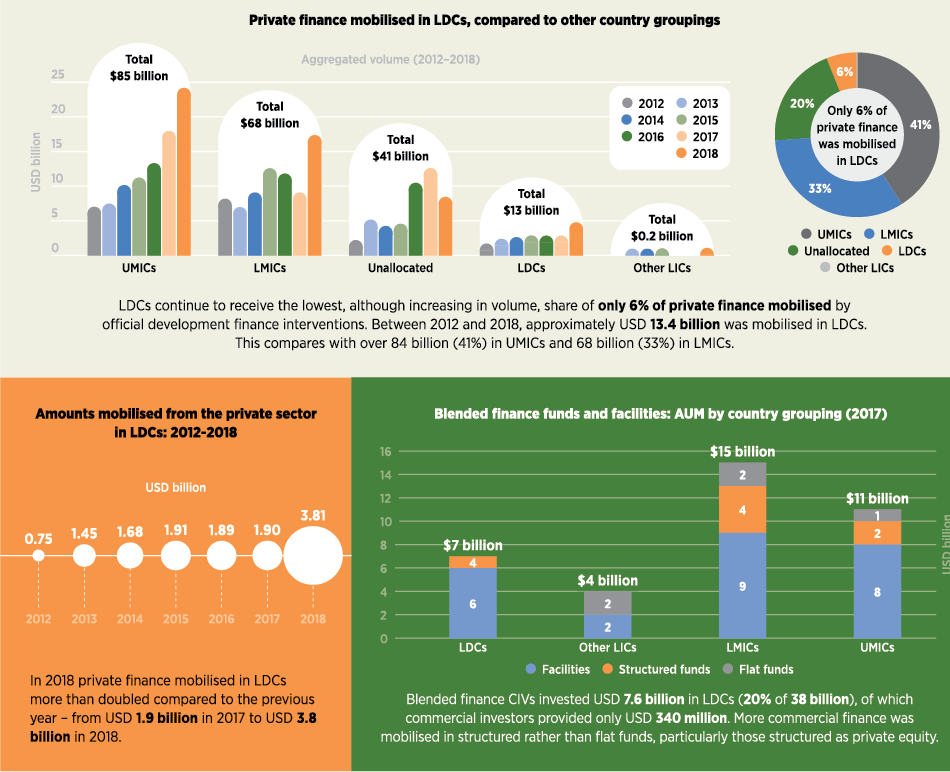

Between 2012 and 2018, investments made by governments using aid funding encouraged the private sector to invest $13.4 billion in LDCs. This is also known as blended finance – when a government or philanthropic institution makes an initial investment to get a project off the ground, even if that means accepting larger risks or lower returns. This innovative financing approach makes a project more attractive to private investors who seek higher financial returns but require lower risk, which is particularly important in LDCs where investment risks are high and numerous.

Blended finance is already providing small businesses in LDCs with short-term solutions, such as desperately needed cash to pay suppliers during COVID-19. Blended finance is also helping LDC governments access sufficient funding to respond to short-term challenges, like trade finance for supplies, or working capital to keep businesses afloat.

But what blended finance offers that other financial instruments don’t is access to long-term significant investment. Because blended finance uses aid to provide investors with safeguards against financial risks, it’s able to attract interest from institutional investors, such as pension funds and insurance companies that would not otherwise invest in LDCs.

Initiatives such as the SDG500 launched at the 2020 World Economic Forum Annual Meeting have been pioneering blended finance instruments in LDCs. Take the Agri-Business Capital Fund (ABC Fund), one of the six funds under SDG500. The Fund aims to mobilize €200 million from public and private investors; for every dollar of aid assistance or public funds used, an additional $2.50 is invested by the private sector in the SDG500 funds. Public investors in the ABC Fund already include the EU; the Organization of African, Caribbean and Pacific States; the Luxembourg Government; the Alliance for a Green Revolution in Africa; and the Swiss Development Cooperation.

During COVID-19, The ABC Fund has made two new investments to support smallholder farmers. It provided much-needed loans worth €1.2 million to two small businesses – Anatrans, a cashew nut processor based in Burkina Faso, and Maphlix, a Ghanaian producer and processor of tubers and vegetables.

This financing has enabled both businesses to continue paying farmers and suppliers, as well as purchase equipment to introduce physical distancing measures in their operations. Enabling businesses like these to continue their operations and grow their businesses, even during tough times, is what is needed to help them build financial resilience.

However, these examples are not the norm. Before the pandemic, only 6% of private finance mobilized by aid benefitted LDCs. And these private finance deals are smaller in LDCs, compared even to other developing countries.

Making blended finance work for the countries that need it most

Increasing private investment in LDCs will require a multi-pronged approach. De-risking efforts, such as the ones offered by blended finance, are important but that alone will not attract sufficient investment.

In our conversations with private finance actors, we hear that they are struggling to secure the aid assistance needed for blended finance to work at scale, and we know that COVID-19 will exacerbate this.

Governments providing aid need to “walk the talk” and find creative solutions to take the much-needed risk themselves for private sector to follow. This could mean taking more risk when assessing real or perceived risks as they prioritize aid budgets, as well as increasing support for blended finance tools that support LDCs. It also means supporting LDC governments to lead and take ownership of the opportunities brought by blended finance.

LDC governments also have an important role to play, by doing what they can to create a strong investment climate in their countries. This includes removing hurdles that are discouraging investors, such as unnecessary screening mechanisms, business registration processes, licensing processes, and lack of protections for foreign investors. They also need to build the capabilities of small businesses to ultimately make it more attractive for blended finance investments to flow. It will be important to continue technical assistance offered through aid programmes to help small businesses strengthen their financial practices, improve operational efficiency, and promote adherence to environmental, social, and governance standards.

It’s clear that if aid budgets are cut, LDCs and the small businesses that are the backbone of local economies and livelihoods, will undoubtedly suffer the most. Developments in blended finance during COVID-19 provide hope that we are heading in the right direction. It is not too late to use aid to attract private investment to flow into the world's poorest countries – but the time to act is now.

Originally published by Thompson Reuters Foundation News on 22 December 2020

If you would like to reuse any material published here, please let us know by sending an email to EIF Communications: eifcommunications@wto.org.